If I add an expense transaction and allocate it to the Emergency Fund savings, the amount drops to $0. That was only what I had planned to save in October, I haven’t added a transaction showing I “saved” that amount. What is a little confusing is that the $385 “saved so far” is a misnomer. Here’s the box for the first step, saving a $1,000 Emergency Fund. There’s a section that talks about those steps and tracks your progress. On the dashboard, bars will show your progress:ĭave Ramsey is well known for his Baby Steps, a set of seven money “steps” that he has shared for decades. The only difference is the button changes to “Track Income” instead of “Track Expense”.

If you switch the transaction type to income, the options don’t change. If you click on more options, you can add a Check # as well as Notes. I showed it split across Restaurants and Fun Money. You can split the transaction across many categories. You can add an income or expense transaction, the screen above shows an expense at Chipotle for $15.

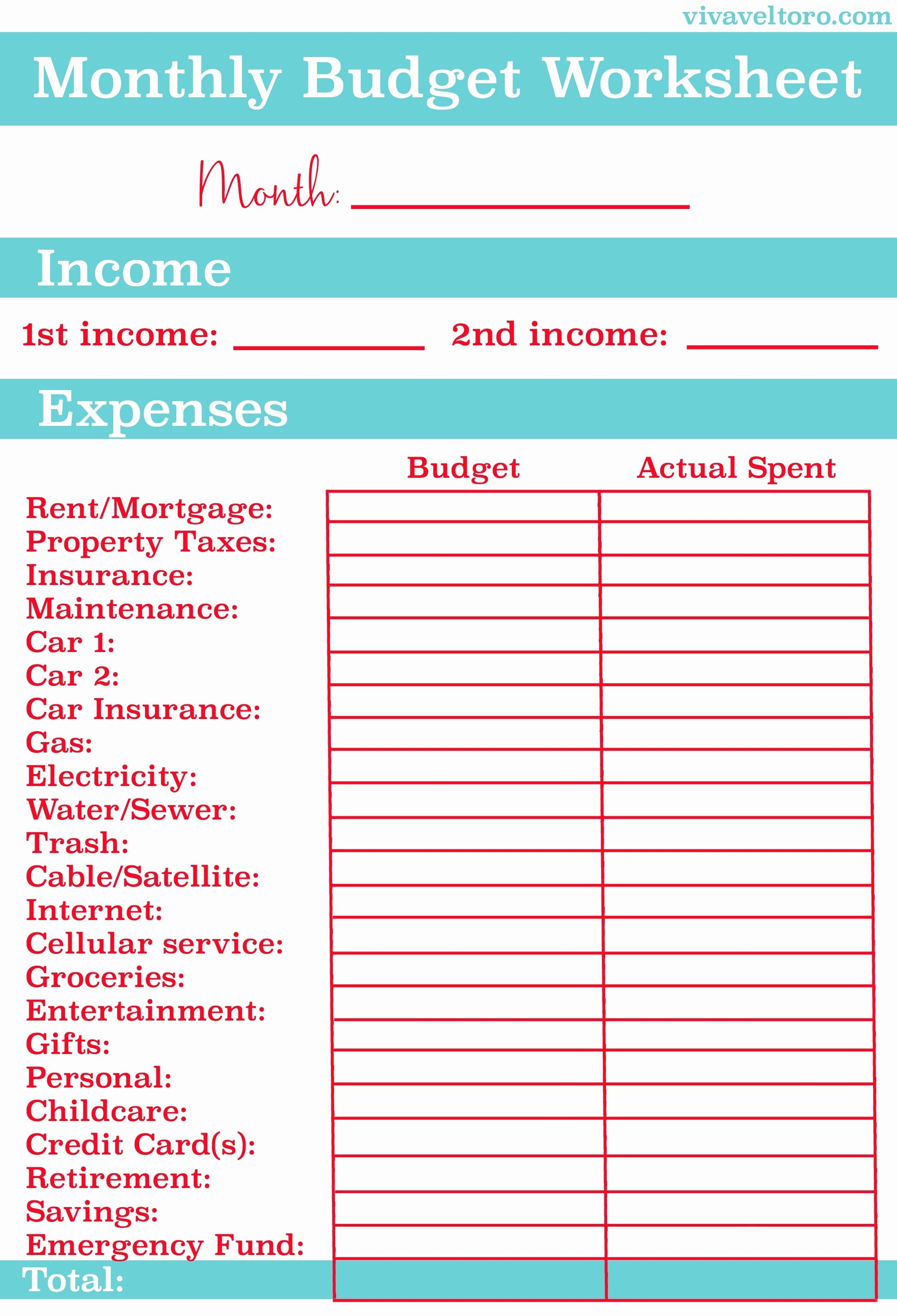

You don’t track actual earning and spending until you add transactions. Up until now, you were setting your planned spending amounts. When this happens, the text underneath the Month and Year will say: “It’s an EveryDollar Budget!” Adding Transactions You’ll notice the Savings line item called Emergency Fund has a planned $385.00 figure. The quickest way to get this in balance is to put that surplus into a savings category on the dashboard: Since debt payment is the last expense to enter, you’ll have a surplus or a deficit. This is what EveryDollar says after you enter in your debts: You will notice that your mortgage payment, while technically a debt payment, is NOT included in this list. Note: You’re supposed to enter the monthly payments, not the amount of debt owed. Throughout the process, you can review how well you’re allocating your income.įinally, the coup de grace, you have debt payments: You can edit the names of the line items and add new items to each list. Then you’ll enter your basic expenses (housing, utilities, food, transportation and “personal expenses”): If you are paid every two weeks, you can set the income to be your total in a month or set two (or three depending on the month) line items for the two pay cycles. You can add as many Paychecks as you want. After you register, you’re asked to pick one or more money goals: It’s a very popular alternative to Quicken. If you pay for EveryDollar Plus, you can link accounts and it’ll automatically pull in transaction data.

Dave ramsey budget free#

If you have the free app, you manually enter your transactions. Then you use the app to track your spending daily. You set up budgeting categories and then allocate your income to those categories. This is where you input your monthly income and plan your entire month’s spending ahead of time. In zero-based budgeting, you assigned every dollar to a category. Let’s see how EveryDollar works: Table of ContentsĮveryDollar uses the budgeting system known as zero-based budgeting. You don’t have to agree with his personal and political views if you want to use his personal finance approach. I’ve talked to people who used his books to get their financial life in order.

Dave ramsey budget plus#

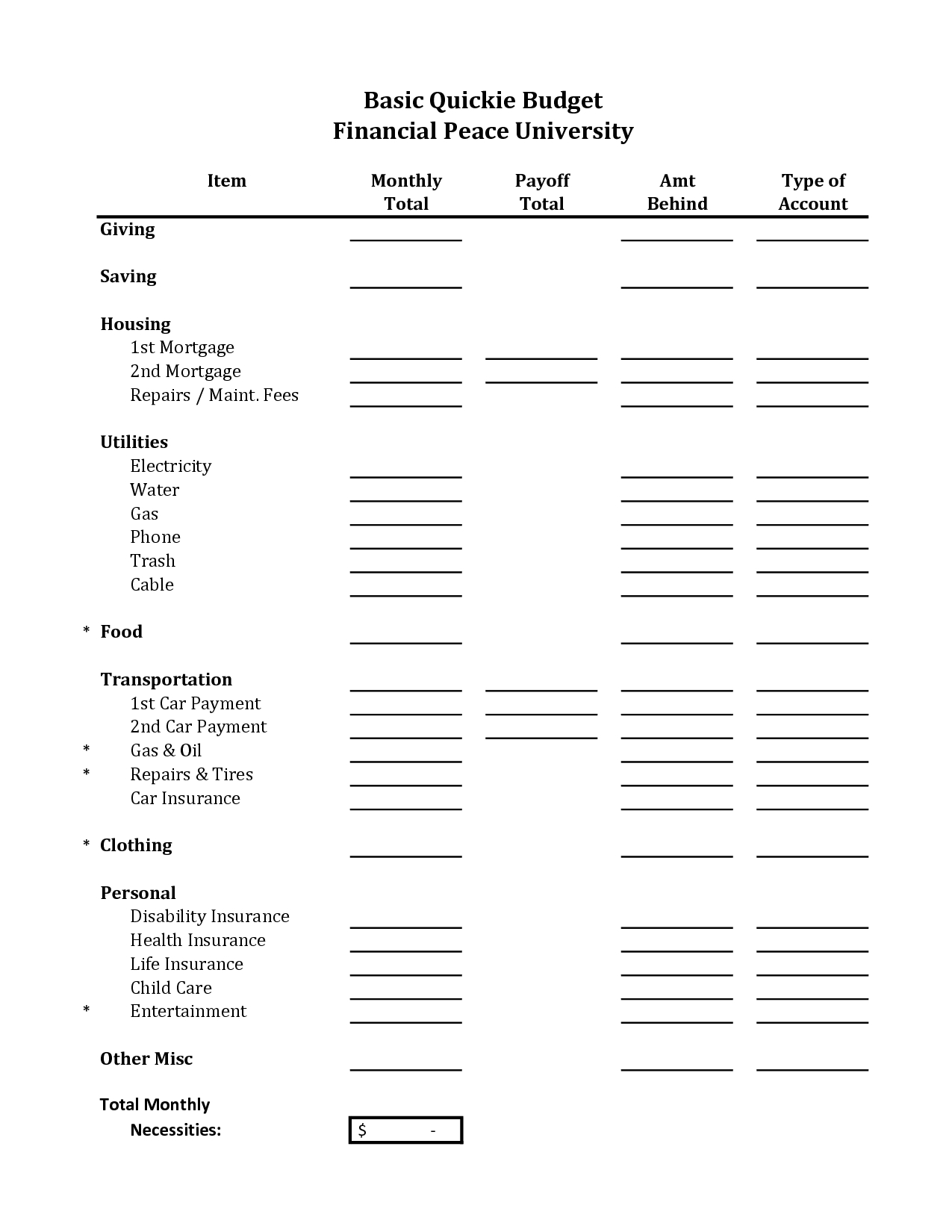

Ramsey Solutions is the organization behind Dave Ramsey, the personal finance media personality.ĮveryDollar once offered a free version, where you had to manually enter in transactions, but that has gone away with the introduction of Ramsey+, which is EveryDollar Plus and a suite of financial courses.ĮveryDollar relies on his money principles, known as the Dave Ramsey Baby Steps, and the debt snowball repayment technique.ĭave Ramsey can be a polarizing figure but so many have used his approach to get out of debt. EveryDollar is the budgeting app built by Ramsey Solutions (formerly Lampo Group) and part of Ramsey+. One of the more well-known apps in this space is EveryDollar. (if you do, here are a few free budgeting spreadsheet templates to get you started!)

If you want to get better at managing your money, you should start with a budget.īut who wants to track everything in a spreadsheet?

0 kommentar(er)

0 kommentar(er)